bonprix: Using artificial intelligence to combat online fraud attempts

press release

•18.03.2021

The Otto Group's international fashion company has been successfully using artificial intelligence (AI) for years to analyse and manage complex data. In addition to applications for size advice and product range planning, fraud prevention is now also benefiting from this adaptive technology: bonprix has developed its own AI-based fraud detection model to prevent online fraud.

As part of its innovation strategy, bonprix is continuously developing its services and technological processes, whether for an optimal online shopping experience or for business processes in the background. The use of artificial intelligence is playing an increasingly important role in this and is now also optimising fraud prevention. ‘Online retailers are currently faced with the challenge of making the shopping process in their web shops fraud-proof while at the same time offering comprehensive service, fast processes and a wide range of payment options,’ explains Marco Annen, Head of Credit and Payment and jointly responsible for fraud prevention. ‘We are committed to ensuring that our customers can shop with us safely and with peace of mind, without having to sacrifice convenience.’

Improved detection of fraud attempts through artificial intelligence

In order to detect fraud attempts in good time, bonprix has established a comprehensive verification process consisting of three pillars: Firstly, external, rule-based software from the Otto Group company RISK IDENT is used. Secondly, a trained and proven team of internal specialists checks for possible fraud attempts – and since 2019, the innovative fraud detection model developed in-house has successfully complemented the process. The learning ability of AI in particular offers great potential to significantly improve customer service and satisfaction – and to make online shopping even more secure. All fraud prevention checks are carried out in strict compliance with the General Data Protection Regulation (GDPR).

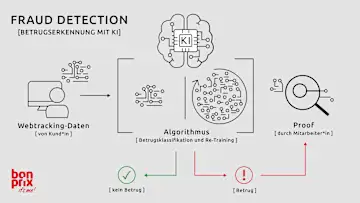

The RISK IDENT software checks transactions on the basis of analytically optimised static and dynamic rules. These are mostly based on device, geo and transaction data. In addition, bonprix now also files user behaviour during a shopping session, which can reveal a lot about fraudulent intent – using its own fraud detection model. It uses machine learning methods that are highly flexible, self-learning and capable of recognising complex patterns in shopping sessions that indicate an attempt at fraud. These patterns consist of countless attributes that only when linked together give rise to suspicion of fraud.

Machine learning model proves its worth in the ‘corona year’ 2020

An initial version of the fraud detection model was launched in March 2019 in Germany, Austria and Norway and was initially trained with a large amount of basic data from historical purchase transactions that had been checked for suspected fraud. After a six-month test phase, the model was further developed through regular retraining with current data: since then, the identification of conspicuous patterns and the adjustment of the model using optimised parameters has been happening automatically.

The learning and development capabilities of the fraud detection model were put to the test once again with the onset of the coronavirus pandemic last spring: the general surfing, clicking and purchasing behaviour of users in the online shop changed to such an extent that the patterns previously identified as suspicious were overlaid. Thanks to its high adaptability, the model was able to be quickly and efficiently adapted to the new conditions.

Further development and learning – the interplay of people and technology

Despite the high degree of automation, people remain the most important factor for success here too. This is because the performance and quality of the model depend largely on the assessments of the employees in the specialised teams, who continue to manually check every transaction classified as potentially fraudulent.

"We are very satisfied with the results of the fraud detection model so far. Since the start of the project, the tool has identified five-figure transactions as potentially fraudulent, and several thousand of these have been blocked after final review by our internal teams. Twelve to fifteen per cent of the cases would not have been detected at all without fraud detection. At the same time, we are constantly gaining new insights and are able to adapt well to changing conditions, such as the current coronavirus pandemic,‘ says Markus Fuchshofen, Managing Director responsible for e-commerce management, domestic sales and branding at bonprix, summarising the experience with the adaptive technology. ’We see real-time fraud detection as the next important step in further development."

share this article

tags in this article

Press contact

Katharina Schlensker

Lead external corporate communications / Spokeswoman

- corporate@bonprix.net